Factoring Basics

Factoring is the act of selling an asset at a discount for the advantage of immediate cash. As a business, it has been around for hundreds of years. In fact, if you want a Biblical reference to discounting invoices check out Luke16: 1- 13.

In the United States, factoring most likely got its foothold at the docks on the East Coast. When the growers brought their crops, mostly cotton, to places like Savannah they placed them in dockside warehouses and proceeded to wait for the ship to arrive to buy their crops. Hence developed the saying “waiting for your ship to come in.”

Today, if you go to Savannah, Georgia, along the docks you just might see an old street sign with the words, “Factors Row.” All along that row of small offices sat Factors who would buy the title to the farmer’s crop at a discounted price. The farmer could then go home and tend his farm while the factor waited for the ship to come in that would buy that crop.

Time was very valuable to the farmer. If you have ever spent any time on a farm, you know that farms don’t do well when left unattended. The farmer knew the value of his time. Too much time spent waiting for that “ship to come in” could cost him dearly. The factor performed a very valuable service to the farmer. And the farmer got back to what he does best.

Well, from the docks of Savannah to the mills of the Carolinas, factoring followed the cotton. Each step along the way one business after another added value to the cotton and was faced with the long wait for the buyer to pay the bill. Eventually the cotton and the factoring arrived in the garment districts of New York.

The factoring business was very slow to make the transition to other industries in the US. Eventually, however, it did jump and this time it was to the emerging auto industry. In fact, it is rumored, that one of the largest and oldest car manufacturers in the US once required their suppliers to show proof they could “carry” the manufacturer’s invoices for 90 to 120 days. If the supplier could not show the financial strength required, the car manufacturer required that the supplier provide the name of his factor.

In the Southwestern US as recently as the 1980’s, factoring was relatively unknown. Today, however, factoring is available to almost any known industry. The basics are still fairly simple: a vendor, subcontractor, or supplier to a larger company needs to be paid sooner than the larger client company is able or willing to pay.

For the vendor, subcontractor or supplier, this delay can be distressing. Not only do they have the cost of producing and delivering their product or service, but they have the additional expense of lost opportunity – they cannot take on more business because their capital is tied up in receivables.

Again, this “ship” with the invoice payment on it is slow to arrive. Just as in Savannah, the factor cashes out the vendor; subcontractor or supplier at a discount and the large Client Company pays the factor in due course. The vendor, subcontractor or supplier takes the relatively small trade discount off the face value of the invoice in exchange for immediate cash, which is then available to fund new business. Thus factoring funds business growth.

VALUE PROPOSITIONS

WORKING CAPITAL – INVOICED GOODS OR SERVICES WITHOUT A/R TERM DELAY

BANKING PARTNERSHIPS – INCREASED CLIENT RETENTION AND DEPOSIT GROWTH

ACQUISITION FUNDING – EARN OUT BASIS OF SELLER’S INVOICES

STARTUP FUNDING – POST REVENUE

Benefits to a start- up company include:

- The ability to make payroll while waiting for slow-paying clients

- The ability to purchase materials and inventory at a discount by paying cash

- The ability to “get started” without sacrificing equity

- The ability to “get started” at all, without investor dollars

- The ability to pay 940’s and 941’s without penalties

- The ability to pay overhead in a timely fashion

Start-up companies inevitably are under-capitalized. It always takes more money and more time to get a business up and running than was budgeted – that is just a fact. So, the availability of working capital early on can mean the difference between being an ongoing success or a mere statistic.

Benefits to an established company include:

- The ability to fund new contracts and new orders

- The ability to pay cash and take discounts from suppliers

- The ability to grow through acquisition (using cash from A/R to fund the acquisition)

- The ability to fund internal growth SPIKES

- The ability to expand into new territories or new lines

- The ability to retain equity when others might have to sacrifice it

- The ability to avoid tax penalties

- The ability to work out of a tax liability

- The ability to fund a buyout of a retiring partner or heirs

- The ability to avoid long term debt

Mechanics of Factoring

Essentials

In order to factor, most businesses will need to provide some fundamental information to the Factor. With this information, the Factor will determine whether or not factoring will benefit the prospective client. This information usually consists of:

- A one page application

- Copies of the company’s Articles of Incorporation, Limited Liability Company or Limited Partnership Organization, or Assumed Name Certificate

- An aging of the company’s receivables and payables

- Recent tax return or financial statement on the company

If a business is a start-up, don’t worry. The Factor can help the start-up, too. As soon as the start-up generates a single receivable on a credit-worthy seller-debtor, the Factor can purchase that receivable and generate cash flow for the start-up.

- The Factor’s approval process, including a review of the submitted documents, lien searches and credit reports, usually takes about a day.

- The next step is entering into an agreement with the Factor. This is usually an industry standard agreement whereby a business agrees to sell and the Factor agrees to buy invoices approved by the Factor at prearranged discounts for the time it takes the invoices to pay.

- Reputable Factors do not charge application fees, handling fees, due diligence fees, interest, or processing fees. The up-front expenses incurred by the experienced Factor are considered a cost of doing business.

- Once the contract is signed, the Factor must begin the process of confirming the invoices. Just as no one would want to buy a car without knowing that it will run, the Factor does not want to buy invoices without knowing they will be paid. When handled by seasoned professionals, this process goes very smoothly. Most reputable Factors employ well trained personnel who know how to graciously engage accounts payable personnel and get the invoices paid. Seldom is it necessary ever to speak to anyone beyond the accounts payable office.

- Upon confirmation of the receivables, an arrangement is made with the accounts payable personnel to direct the payment to the Factor’s lock- box. This would be a lock- box arrangement just like a bank will use for a traditional line of credit. Accounts Payable personnel are very familiar with this process and are quickly able to make the necessary remittance changes. The confirmation process usually takes from a couple of days to a week depending on the number of accounts to be factored. Once completed, funding can occur immediately.

After the initial funding, most good factoring firms will be able to fund your additional requests within 24 hours of receipt of funding documents on approved accounts. Funding usually occurs via wire transfer or ACH. Funds electronically deposited are immediately available to the business.

So, the process is this simple:

- Application and submission of the required documents

- Approval by the Factor on agreed terms

- Execution of the Factoring Agreement including UCC filing

- Credit approval of individual accounts by the Factor

- Submission of invoices to be discounted along with proof of performance

- Verification and confirmation of invoices by the Factor

- The Factor funds the approved, verified and confirmed invoices

Why does the Factor need a signed application? The application, which is ordinarily a one page document, usually establishes the company name and address, the ownership of the company, the size of the accounts receivable outstanding, whether or not the business has filed bankruptcy, and a few other simple facts about the business. Perhaps most importantly, it contains an authorized signature giving permission to the Factor to verify the facts provided and to check personal and business credit.

Factors are in the risk management business. They need to take steps to ensure that they are dealing with legitimate companies who produce and deliver legal products and services. In today’s world, they are required to take prudent steps to ensure they know with whom they are transacting business. Think of it this way: no business can acquire a credit card without credit being checked.

The next step is entering into the Factoring Agreement. This industry standard document is a contract that must contain a security agreement between the company and the Factor. This is the place where the business agrees to sell receivables and the Factor agrees to purchase those that meet the credit standards of the Factor. The discount price should be clearly stated in an understandable manner.

Additionally, the Factoring Agreement should explain what happens if the customers do not pay the receivables the business sold to the Factor. The Agreement will also state clearly what the available maximum credit limit with the Factor is.

After the Factoring Agreement is signed, the business will begin to submit credit requests and individual invoices for funding. It should be expected to have individual credit limits on the business’ customers as well. Remember a Factor wants to buy good accounts. The Factor is not a collection agency that might buy some bad debt. The Factor wants to buy only those credit-worthy accounts that will pay in a reasonable amount of time.

The invoices should carry unique numeric identifiers and should have any Purchase Order number or client number or work Order number required by the specific customer. Invoices must contain the customer’s name and the address being billed along with any separate delivery address used. These invoice specific details along with the Proof of Performance will not only satisfy the Factor but they will facilitate the invoices being paid in a timely manner, thus costing less in fees. Remember: the more detailed the invoices, the faster they get paid.

What questions should I ask myself to determine if I am a candidate for factoring? That is easy. You know your business. Are you looking for capital? Are you hoping that someone out there will give you the money you need to grow your business? Ask yourself these questions:

- If I had the money in cash from my receivables right now, would I take on new jobs?

- If I had the money in cash from my receivables right now, could I get some suppliers off my back?

- If I had the money in cash from my receivables right now, would I use it to meet payroll?

- If I had the money in cash from my receivables right now, could I take care of the IRS?

- If I had the money in cash from my receivables right now, would I be able to focus on something other than collections and juggling payables?

- If I had the money in cash from my receivables right now, could I avoid giving up equity in order to grow the business?

- If I had the money in cash from my receivables right now, would I buy that competitor of mine who is supposedly for sale?

If you answered yes and especially if you smiled and answered yes, you just might be a candidate for factoring. At least give it some thought. You may be concerned about what other people will think. Don’t be. If you are dealing with a well established, reputable factoring firm, their contact with those “other people” will usually be limited to the accounts payable personnel. Accounts payable personnel deal with factored accounts every day.

The payables personnel do not “judge” you if you factor your receivables. They don’t want to pay for work that has not been done and they don’t want to send the money to the wrong place. Other than that, it is business as usual for them.

In fact, you have just demonstrated to anyone who cares that you are a stronger company: you have cash in the bank (from factoring your receivables) with which you can keep your bills paid. Thus you are a stronger company than before you factored. You have avoided creating long term debt. Factoring never creates long term debt that would have to be repaid in bad times as well as good. Any business that survived 9/11 in the United States knows that bad times can come suddenly and unexpectedly. Not having long term debt can mean you survive when others do not. Never create long- term debt to meet short- term needs in your business. Factoring allows your business to “pay as it grows” without losing equity and without long- term debt.

VALUE PROPOSITIONS

WORKING CAPITAL – INVOICED GOODS OR SERVICES WITHOUT A/R TERM DELAY

BANKING PARTNERSHIPS – INCREASED CLIENT RETENTION AND DEPOSIT GROWTH

ACQUISITION FUNDING – EARN OUT BASIS OF SELLER’S INVOICES

STARTUP FUNDING – POST REVENUE

Brenda Standlee Wetherbe

President

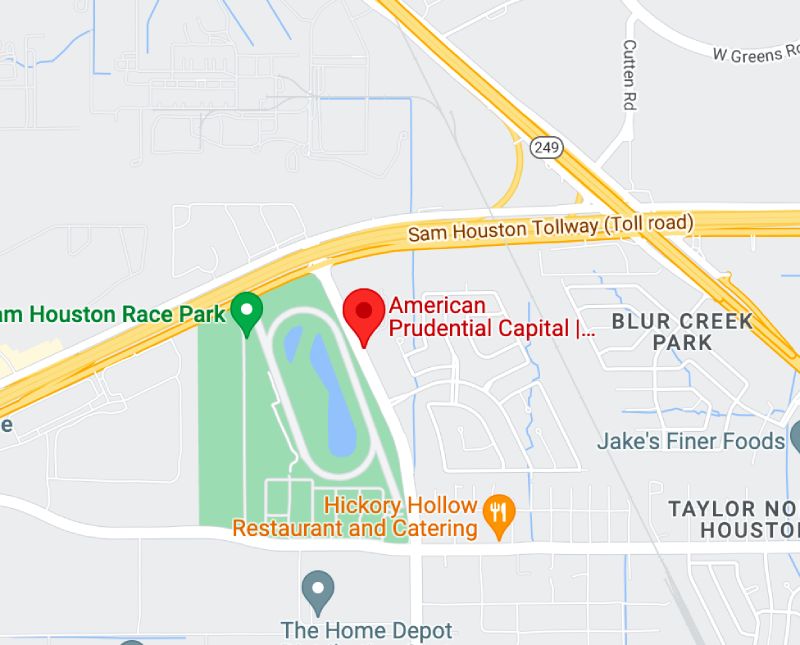

Tel: (713) 690-8877 x211

Email: brenda@americanprudentialcapital.com

Website: www.americanprudentialcapital.com